Budget Challenge Chapter 3 Quiz Answers: Your Ultimate Guide To Mastering Financial Literacy

Alright, listen up, folks. If you're here for the budget challenge chapter 3 quiz answers, you're definitely not alone. Let's be real, navigating financial quizzes can feel like trying to solve a Rubik's Cube blindfolded. But don’t sweat it! We’ve got your back. Whether you're a student diving into personal finance for the first time or someone brushing up on their skills, this article is your golden ticket to acing that quiz. Buckle up, because we're about to break it down step by step.

Now, before we dive deep into the answers, let's take a moment to understand why this quiz matters so much. Financial literacy isn’t just some buzzword; it’s a life skill that’ll help you make smarter decisions with your money. The budget challenge chapter 3 quiz answers aren’t just about passing a test—they’re about equipping you with the knowledge to manage your finances better. So, whether you're saving for a dream vacation or planning for retirement, this is where it all begins.

And hey, don’t worry if you’re feeling overwhelmed. This guide isn’t just about dumping information on you. It’s about making sure you walk away confident, informed, and ready to tackle whatever financial challenges come your way. So grab a coffee (or tea, if that’s your thing), and let’s get started.

- Aisling Franciosi Der Aufstieg Eines Stars Was Macht Sie So Besonders

- Luis Elizondo Die Wahrheit Was Steckt Hinter Uaps Jetzt Enthllt

Table of Contents:

- What is the Budget Challenge?

- Why Chapter 3 Matters

- Common Questions About Budget Challenge Chapter 3

- Step-by-Step Guide to Quiz Answers

- Key Concepts You Need to Know

- Tips for Success

- Understanding Budgeting Tools

- Real-Life Examples

- Mistakes to Avoid

- Final Thoughts and Call to Action

What is the Budget Challenge?

Alright, let’s start with the basics. The budget challenge is more than just a quiz or an assignment—it’s a program designed to teach people (especially students) how to manage their money effectively. Think of it as a crash course in personal finance, but way more engaging. Each chapter focuses on a different aspect of budgeting, from setting goals to tracking expenses, and chapter 3 is all about putting those skills into practice.

Chapter 3 dives deep into creating a realistic budget, understanding fixed vs. variable expenses, and learning how to adjust when life throws curveballs. It’s like the "practical application" phase of your financial education. And trust me, mastering these concepts will set you up for long-term success.

- Bollywood 2025 Was Filmfans Jetzt Ber Filmyfly Co Wissen Mssen

- Filmywap Filmyfly Ist Kostenloses Streaming Legal Infos 2024

Why Chapter 3 Matters

Chapter 3 is where the rubber meets the road. While earlier chapters might have covered theory, this one forces you to apply what you’ve learned. It’s like being handed the keys to a car after learning how the engine works—you’re ready to drive!

Here’s why chapter 3 is such a big deal:

- It teaches you how to create a budget that actually works for your lifestyle.

- You’ll learn to identify and prioritize your financial goals.

- It helps you understand the difference between needs and wants, which is crucial for saving money.

- Most importantly, it gives you the tools to adapt when unexpected expenses pop up.

So, if you want to ace the budget challenge chapter 3 quiz answers, you need to grasp these concepts inside and out.

Common Questions About Budget Challenge Chapter 3

Before we jump into the answers, let’s tackle some frequently asked questions. These are the kinds of queries that pop up a lot when people are working through this chapter:

Q1: What are fixed and variable expenses?

Fixed expenses are those that stay the same every month, like rent or car payments. Variable expenses, on the other hand, fluctuate depending on your usage or choices, like groceries or entertainment.

Q2: How do I set realistic financial goals?

Start small and specific. Instead of saying “I want to save money,” try “I want to save $100 a month for the next six months.” Breaking it down makes it easier to achieve.

Q3: Why is emergency savings important?

Because life happens! An emergency fund ensures you’re prepared for unexpected expenses without going into debt. Think of it as your financial safety net.

Step-by-Step Guide to Quiz Answers

Alright, let’s cut to the chase. Here’s a detailed breakdown of the budget challenge chapter 3 quiz answers:

Answer 1: Understanding Your Income

This question usually asks you to calculate your total monthly income. Remember to include all sources of income, including part-time jobs, side gigs, and any passive income streams. Pro tip: Don’t forget to subtract taxes and deductions to get your net income.

Answer 2: Categorizing Expenses

When categorizing expenses, make sure to separate them into fixed and variable. Fixed expenses are easy to track since they don’t change, while variable expenses require more attention. Keep receipts and track your spending for at least a month to get a clear picture.

Answer 3: Setting Financial Goals

Your goals should align with your priorities. For example, if you’re saving for a vacation, allocate a specific amount each month toward that goal. Make sure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Answer 4: Creating a Budget

Use the 50/30/20 rule as a guideline. Allocate 50% of your income to needs (housing, food, utilities), 30% to wants (entertainment, hobbies), and 20% to savings and debt repayment. Adjust as needed based on your situation.

Answer 5: Adjusting for Unexpected Expenses

Life happens, and budgets need to be flexible. If an unexpected expense arises, review your spending and see where you can cut back temporarily. Your emergency fund should cover most surprises, but it’s okay to tweak your budget occasionally.

Key Concepts You Need to Know

Here are some essential concepts that’ll help you ace the quiz and beyond:

- Net vs. Gross Income: Net income is what you take home after taxes and deductions, while gross income is your total earnings before anything comes out.

- Opportunity Cost: Every financial decision has a trade-off. For example, buying a new phone might mean delaying your vacation savings.

- Debt-to-Income Ratio: This measures how much of your income goes toward paying off debts. Aim to keep it below 36% for financial stability.

Understanding these concepts will give you a solid foundation for managing your money.

Tips for Success

Now that you’ve got the answers, here are some tips to help you succeed:

- Stay consistent with tracking your expenses. Use apps or spreadsheets to keep everything organized.

- Review your budget regularly to ensure it still aligns with your goals.

- Don’t be afraid to ask for help if you’re stuck. Whether it’s a teacher, mentor, or online resource, there’s no shame in seeking guidance.

Remember, financial literacy is a journey, not a destination. Keep learning and adapting as you go.

Understanding Budgeting Tools

There are tons of tools out there to help you manage your budget. Some popular ones include:

- Mint: A free app that connects to your bank accounts and tracks your spending automatically.

- YNAB (You Need A Budget): A powerful budgeting tool that focuses on giving every dollar a job.

- Excel Spreadsheets: If you prefer a hands-on approach, creating your own spreadsheet can be a great way to customize your budget.

Experiment with different tools to see which one works best for you.

Real-Life Examples

Let’s look at a couple of real-life scenarios to see how these concepts play out:

Example 1: Sarah’s Budget

Sarah earns $3,000 per month after taxes. She allocates $1,500 to rent, $600 to groceries and utilities, $300 to savings, and the rest to discretionary spending. When her car breaks down unexpectedly, she uses her emergency fund to cover the repair costs without derailing her budget.

Example 2: John’s Debt Repayment Plan

John has $5,000 in credit card debt. He creates a budget that prioritizes paying off his debt while still setting aside money for savings. By sticking to his plan, he pays off the debt in two years and improves his credit score.

Mistakes to Avoid

Even the best budgeters make mistakes. Here are a few common ones to watch out for:

- Overestimating Income: Be realistic about how much money you have coming in each month.

- Underestimating Expenses: Don’t forget about those pesky hidden costs, like subscription services or unexpected repairs.

- Not Reviewing Your Budget: Life changes, and so should your budget. Regularly reviewing it ensures you stay on track.

Avoiding these pitfalls will keep you on the path to financial success.

Final Thoughts and Call to Action

There you have it, folks. The budget challenge chapter 3 quiz answers aren’t just about passing a test—they’re about building a brighter financial future. By mastering the concepts in this chapter, you’re setting yourself up for long-term success. Remember, financial literacy is a skill that’ll benefit you for life.

So, what’s next? Take action! Start applying what you’ve learned today. Create a budget, set some goals, and track your progress. And don’t forget to share this article with someone who could use a hand with their finances. Together, we can make financial literacy a priority for everyone.

Until next time, stay sharp and keep hustling!

- Justin Chambers Das Musst Du Ber Den Greys Anatomystar Wissen

- Trk Fa Was Steckt Hinter Dem Trend Einblick In Die Szene

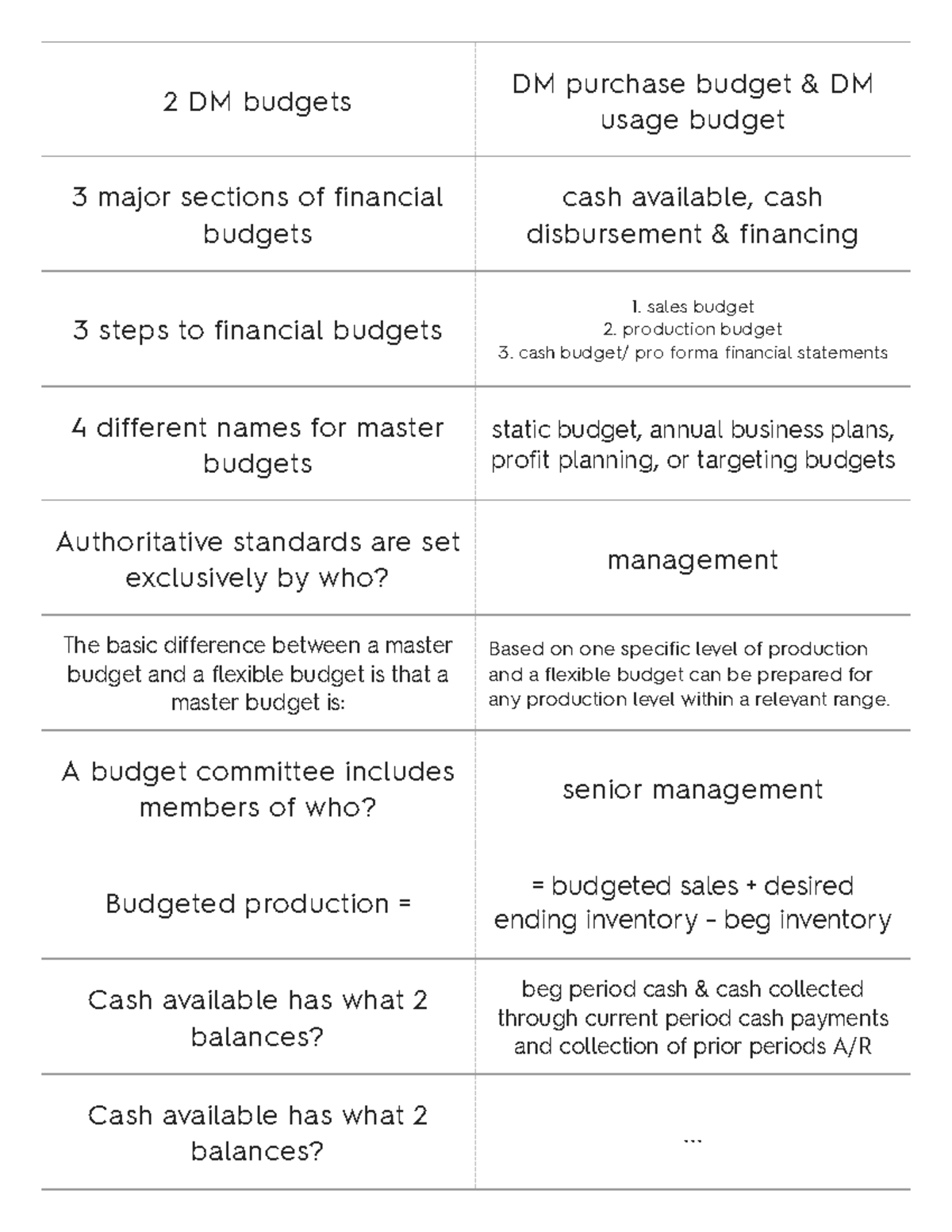

Budget Quiz Answers 2 DM budgets DM purchase budget & DM usage budget

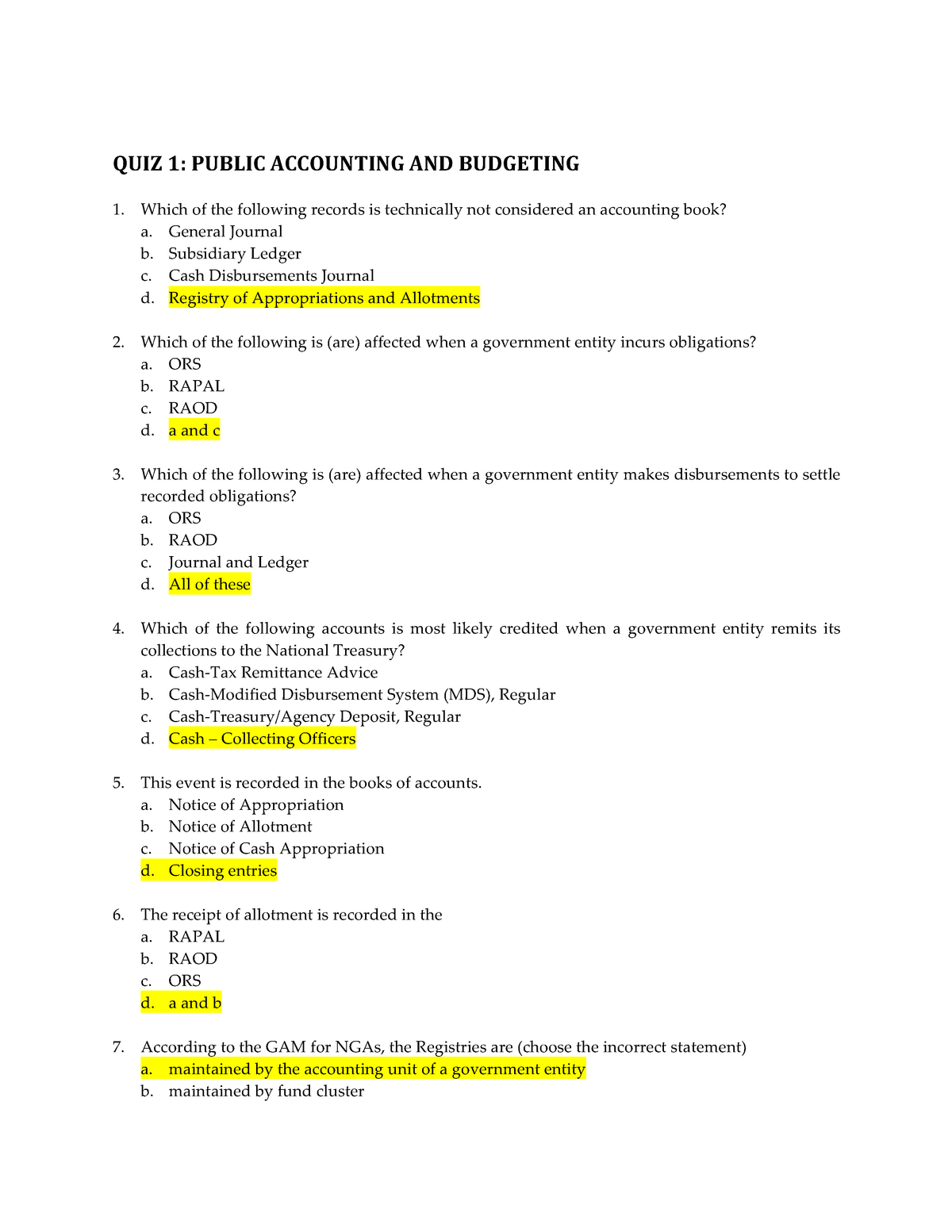

Quiz 14 QUIZ 1 PUBLIC ACCOUNTING AND BUDGETING Which of the

Chapter16 Accountancy materials Chapter 16 MultipleChoice